What are your opinions on travel stocks atm? With stories of airlines flying near-empty planes around the world to countries barely letting anyone in, it seems like the ‘recovery’ many folks were talking about is a way off yet. I’m amazed the Qantas price is pretty much holding steady… for now.

I think long term they are going to go very well. Providing they can stay in business long enough.

Things like Webjet and Flight Center had solid performances pre covid. If you bought in now and held for the long term, im sure there’d be big rebounds as the borders open.

Yes its still an interesting topic… How much patience as an investor should you have?

I held 2014 and sold AirBus (AIR.FRA) in 2020… Looking now with hindsight I probably should have hung in there with them but at that point with no planes flying and all parked in the desert I could not see how they would sell a plane in next 10 years.

But then I’ve reallocated the money elsewhere and done well. That is the opportunity … is your grass greener than mine?

I always try and remember that the market is designed to move money from the impatient to the the patient… Some days I have more patience than others!

This same issue gets played all the time currently MFG (is it oversold) and in the US with Tech is it the start of a correction or do you look at buying the dip?

As regards the direct question on travel my gut tells me that it’s another 12 months before people start to venture out, but I fear that may well be a distinct Victorian view where we’ve had more harsh lockdowns - So it could be a bias view. Elsewhere in Australia and other parts of the world I think there is different opinions… Perhaps I just need to travel out of Victoria for a bit to get more confidence!

But I think @FranGillespie nailed it…

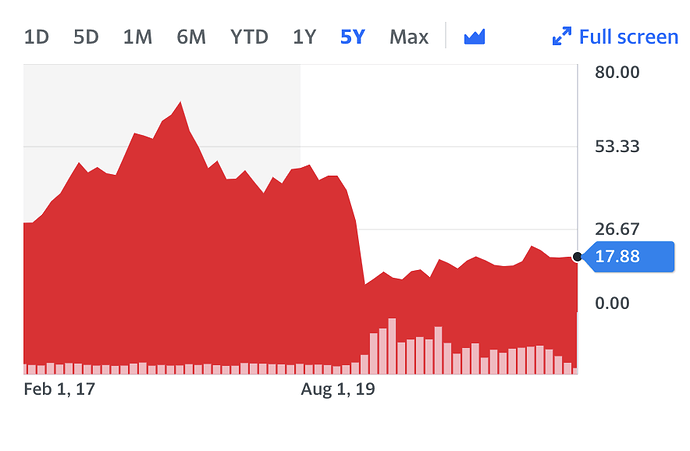

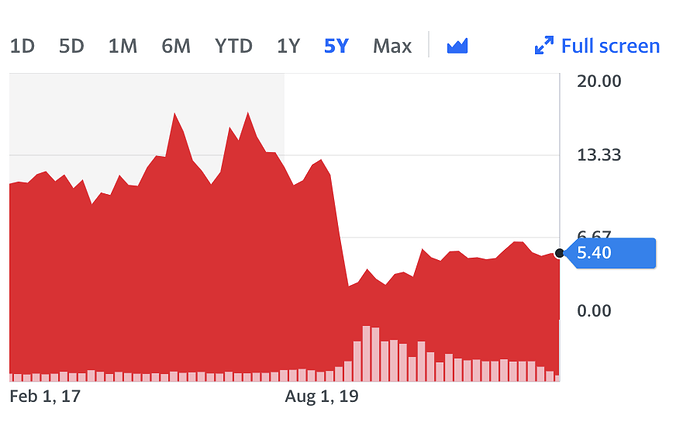

The key in that statement is long enough… It would want to turn soon but I’d want a bit better general economic news before I moved too quick… A fast glance at the charts of those two … its moving up… but its a slow and bumpy road. If I was in I might be tempted to hang on but if I was out I’d think I’ll stay out

The above is Flight Center over last 5 years

The above is Webjet over the last 5 years

The ‘impatient to the patient’ quote is a strong one. I used it in our latest post on the blog.

What it doesn’t account for is time horizons. Someone investing with a 30-year view versus a 10-year view is going to have a very different idea of ‘patience’.

@thom I find it timeless… Be it building wealth (or a position over time) to doing the deal NOW at this price rather than setting a limit…

If you’re dealing in a share with low liquidity then its especially important tactically to be patient else you could drive the price in one direction or another but normally against where you want it.

Other days while we all enjoy a 10 bagger perhaps a bit of boring dependable is not too far from what we need. Never undervalue a bit of boring to get rich slowly. Best car I ever owned was a Merc 300D it did 640,000 km cheapest motoring around but no sports car.

Patience just one of the emotions you have to manage… FOMO (Fear Of Missing Out), TINA (There Is No Alternative), Greed, Fear, Regret, Analysis Paralysis (I drown in data), Need or Want are some of the emotions you need to balance.

But I find trying to apply patience - occasionally does provide clarity to some situations. Conversely it reminds me of that great speech from John Kennedy Snr - AFL Coach some days you just have to do!

The trick is to know when to play what card… While I’d like to say it comes with experience I think Gary Player put it best “The more I practice the luckier I get”. It never hurts in this game to “Just be Lucky”!

And perhaps that’s the bottom line… History repeats - but never in exactly the same way… Any system will work till the situations change and it won’t work any more. Once you realise that there is no silver bullet, no dead cert you can start to manage your emotions and focus on making money.

Just remember in a market you need two people of opposite views in order to get a deal done. At the end of the day one of you will be more correct than the other. Given each outcome of each decision is a 50-50 bet you will not get 100% correct all of the time. So how you manage your errors and ride your gains determines your outcome. In the end you hope you get more of your 50-50’s in your favour than against… But you’ll never hit every ball over the back of the fence. You need to be satisfied with that. But if you never pull the trigger, if you never have a go… you’ll never know what you could become.